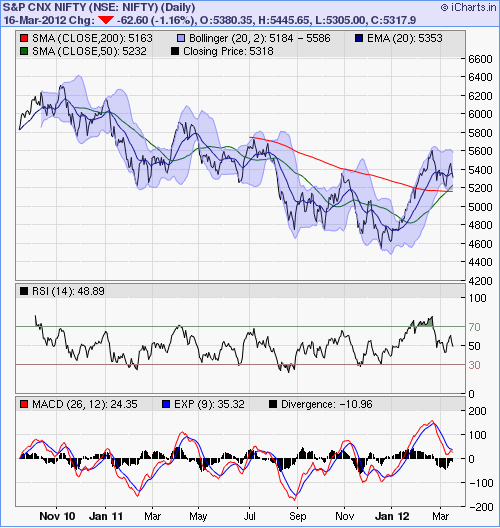

In my previous post I had talked about the high negative correlation between the VIX and its underlying, the NIFTY. The chart on the right shows the actual movements of the NIFTY compared with the corresponding VIX moves. The period covering Mar’09 to Sep’10 marked a very rapid increase in the market (NIFTY rose from 3000 levels to 5,500). Since the VIX indicates volatility, the period at the start of this phase saw the most rapid increase in the NIFTY (in percentage terms) and that is why the VIX readings were above 40% during this time. The period from Sep’10 till date however have seen the market mostly move in a sideways direction. It started off around 5,500 in Sep’10 and is now at the 5,300 levels. Accordingly, if you look at the VIX, it has also remained mostly flat. Now, the big thought in my mind is this: we hear mostly bullish noises these days. Golden Cross; correction within an overall bullish trajectory etc. So, if the negative correlation were to hold and the NIFTY were to move up from now, it is logical to expect the fear (i.e. VIX) to come down from its current levels (~24%) t0 something like a 15% (?) or so. Since the start of this chart (chosen since that is the date range for which NSE publishes its VIX values) marked the markets coming out of a rather exceptional period in its history (global banking sector meltdown), VIX values > 40% may be really rare to come by again in the near future. I have nevertheless plotted a dotted red line on the VIX portion of the chart which shows the median level of the VIX range. In the event that the VIX ‘reversion to the mean’ becomes a reality in the months to come then I guess we should brace ourselves for another secular fall in the NIFTY. If you take the economic events near the starting period of this chart to be exceptional, and ignore the corresponding VIX values as outliers, then the new median will be quite close to where the VIX is today (22% – 24%) in which case there is definitely a case for it to fall down to late teens/earlier twenties. As you can guess I am rooting for a rise in the NIFTY and trying to twist my data interpretation to fit that notion!! 🙂

In my previous post I had talked about the high negative correlation between the VIX and its underlying, the NIFTY. The chart on the right shows the actual movements of the NIFTY compared with the corresponding VIX moves. The period covering Mar’09 to Sep’10 marked a very rapid increase in the market (NIFTY rose from 3000 levels to 5,500). Since the VIX indicates volatility, the period at the start of this phase saw the most rapid increase in the NIFTY (in percentage terms) and that is why the VIX readings were above 40% during this time. The period from Sep’10 till date however have seen the market mostly move in a sideways direction. It started off around 5,500 in Sep’10 and is now at the 5,300 levels. Accordingly, if you look at the VIX, it has also remained mostly flat. Now, the big thought in my mind is this: we hear mostly bullish noises these days. Golden Cross; correction within an overall bullish trajectory etc. So, if the negative correlation were to hold and the NIFTY were to move up from now, it is logical to expect the fear (i.e. VIX) to come down from its current levels (~24%) t0 something like a 15% (?) or so. Since the start of this chart (chosen since that is the date range for which NSE publishes its VIX values) marked the markets coming out of a rather exceptional period in its history (global banking sector meltdown), VIX values > 40% may be really rare to come by again in the near future. I have nevertheless plotted a dotted red line on the VIX portion of the chart which shows the median level of the VIX range. In the event that the VIX ‘reversion to the mean’ becomes a reality in the months to come then I guess we should brace ourselves for another secular fall in the NIFTY. If you take the economic events near the starting period of this chart to be exceptional, and ignore the corresponding VIX values as outliers, then the new median will be quite close to where the VIX is today (22% – 24%) in which case there is definitely a case for it to fall down to late teens/earlier twenties. As you can guess I am rooting for a rise in the NIFTY and trying to twist my data interpretation to fit that notion!! 🙂

The correlation factor in the above chart comes in at a high -0.83. Why such a high number? The reason could be because increased volatility (i.e. high VIX) signifies more risk. To keep their portfolios in line with their risk preferences, market participants must deleverage. Since long positions outweight short positions in the market as a whole, deleveraging entails a lot of selling and less buying (since the longs have to be shortened). The relative increase in selling causes downward pressure on stocks. The volume rise in the NIFTY puts really drives the VIX up. The NIFTY VIX is a weighted sum of puts (strikes < forward) and calls (strikes > forward) on the NIFTY. The weights are proportional to 1 / [(strike)^2]. As the NIFTY goes down, all the out of money puts become more valuable and those start having the highest weights (since the weights are the reciprocals of the strikes).

The unit of measurement of the VIX is in percentage terms. Its value essentially signifies the % expected movement of the NIFTY over the next 30 calendar days. So, for example, since the value of NIFTY VIX was 24.33% (on 29Mar’12), what the market is essentially saying is that it expects the NIFTY to move (either up or down) at a 24.33% annualized rate over the next 30 days. This implies that the market is pricing in a 24.33% /SQRT(12) = 7.02% movement at current levels over the next 30 calendar days. Which btw, is huge! In terms of confidence level, this means that the near term options on the NIFTY are being quoted with the assumption of a 68% likelihood (1 sigma) that the magnitude of NIFTY’s 30 calendar day return will be less than 7.02% (either up or down)

Taleb here points out how even seasoned market participants wrongly derive mean deviation (the 7.02% deviation as at yesterday’s close) from measures of standard deviation. My uninformed take on this is that if all are consistently making this error then that becomes the norm. Consider for instance, that a standard market data provider like Reuters or Bloomberg inadvertently distributes erroneous reference data – since both sides of the trade are using that same value, it becomes the de-facto standard and no one is out of balance.

VIX as a trading indicator: Since the VIX is a measure of dispersion and has a reversal to the mean property, all the standard technical indicators like RSI, Bollinger Bands etc can be used as identifiers for trade entry points. Since we do not have derivatives on the VIX in India yet, these technicals can give entry points into the underlying (i.e. NIFTY) by inverting the logic (buy for VIX would be a sell for NIFTY) due to the high -ive correlation between NIFTY and VIX. There have been studies which point out that the 2 period RSI on the VIX gives a very good trading signal. If the RSI (2) of the VIX >90, then buy the underlying and if RSI (2) < 30, then sell the underlying. Underlying = NIFTY in our case. I do not have any ready charting software at hand, so I will have to painstakingly generate the RSI values in a spreadsheet if I have to test and see how this really could have played out on historical data. Maybe fodder for a future post…

Please scatter it around:

Dividends now represent 27% of the total return index of the NIFTY since the start of 2000. What this means is that assumming that the changes in index constituents are pari passu, if the dividends issued by the component companies of NIFTYwere reinvested/reconsidered back into the NIFTYcalculations then the value of the index would roughly be around 6,728 (27% more than the current NIFTY value of 5295, as at 1Apr’12). The Total Return Index (TRI) tracks the capital gains of the NIFTY stocks and assumes that any cash distributions, such as dividends are reinvested back into the index. The German stock market DAX is an example of a TRI while NSE distributes historical values of its TRI here.

Dividends now represent 27% of the total return index of the NIFTY since the start of 2000. What this means is that assumming that the changes in index constituents are pari passu, if the dividends issued by the component companies of NIFTYwere reinvested/reconsidered back into the NIFTYcalculations then the value of the index would roughly be around 6,728 (27% more than the current NIFTY value of 5295, as at 1Apr’12). The Total Return Index (TRI) tracks the capital gains of the NIFTY stocks and assumes that any cash distributions, such as dividends are reinvested back into the index. The German stock market DAX is an example of a TRI while NSE distributes historical values of its TRI here. I downloaded NIFTY TRI and played around with the data trying to find some patterns and inferences. The first chart is a simple compare of the NIFTY TRI (dark green line) against the NIFTY (dark brown line) with the difference between them shaded in light green. The gap between the two indices is also shown in the second chart. I am unable to make any meaningful conclusion from this chart.

I downloaded NIFTY TRI and played around with the data trying to find some patterns and inferences. The first chart is a simple compare of the NIFTY TRI (dark green line) against the NIFTY (dark brown line) with the difference between them shaded in light green. The gap between the two indices is also shown in the second chart. I am unable to make any meaningful conclusion from this chart. The third chart is interesting. This shows a comparision of the continuously trailing 1 yr returns of the NIFTY TRI compared with the trailing 1 yr returns of the NIFTY since 4Jan2001. Given that the NIFTY continuous 1 yr returns have swung widely over a +120% to -50% range during this period, the difference between the two lines is not noticeable at all. The small footer chart shows the difference between the two series of 1 yr returns. What came out was that the trailing 1 yr returns of the NIFTY are always greater than the trailing 1 yr returns of the NIFTY TRI. Duh. This did not make any sense to me. I guess the major insight, though unrelated to the topic of the post, is the amazing wild swings in the trailing 365 day returns of the NIFTY. Can anyone spell V O L A T I L I T Y for me? 🙂

The third chart is interesting. This shows a comparision of the continuously trailing 1 yr returns of the NIFTY TRI compared with the trailing 1 yr returns of the NIFTY since 4Jan2001. Given that the NIFTY continuous 1 yr returns have swung widely over a +120% to -50% range during this period, the difference between the two lines is not noticeable at all. The small footer chart shows the difference between the two series of 1 yr returns. What came out was that the trailing 1 yr returns of the NIFTY are always greater than the trailing 1 yr returns of the NIFTY TRI. Duh. This did not make any sense to me. I guess the major insight, though unrelated to the topic of the post, is the amazing wild swings in the trailing 365 day returns of the NIFTY. Can anyone spell V O L A T I L I T Y for me? 🙂

Recent Reactions