Rishab asked me to write something about infrastructure bonds which I do later in this post but before that something about the fascinating world of economic hit men (cool phrase, right?).

_______________________________________________________________________________________

Just finished reading the book “Confessions of an Economic Hit Man” by John Perkins. Fuck. What a book. I’m not referring to the writing style (which is good) but the content – a detailed narrative of the ‘corporatocracy’ of the US and the role that “Economic Hit Men (EHM)” played in it. This represents the latest form of imperialism that has played about and for almost all of us, nearly the only one during our lifetimes.

Just finished reading the book “Confessions of an Economic Hit Man” by John Perkins. Fuck. What a book. I’m not referring to the writing style (which is good) but the content – a detailed narrative of the ‘corporatocracy’ of the US and the role that “Economic Hit Men (EHM)” played in it. This represents the latest form of imperialism that has played about and for almost all of us, nearly the only one during our lifetimes.

The Boston Herald newspaper likened it to something like a conceptual love child of James Bond and Milton Friedman (Nobel Prize economics laureate and advisor to Ronald Reagan). And that is exactly how I felt as I turned the pages – I kept playing and re-playing the storylines of the latest Bond films in my mind. I don’t watch much movies so Bond films are the only flicks that I can relate to in this context. Please read the book (you must) and if you can suggest some other movies (other than “The Panama Deception“) that resonate with the theme please do let me know.

John Perkins now writes about a lot of stuff on his website but I think that this book will always remain his magnum opus. In a nutshell, this is what is the core theme that Perkins talks about, of the post Jimmy Carter US:

– As the US became more and more powerful, its apetite for natural resources grew larger and larger. It’s hinterland, being as rich as it is, was never going to be enough for this world leader which has 765 (!) vehicles per 1000 people. In comparision, China is at 128 and India is just about at (ha ha ha) a dozen (though it is touted to become the larest car market by 2030)!

– So the US has always wanted to look outside its borders (just like every previous empire building state has done in the past) to secure it’s supply lines.

– But new methods were needed in the post WWII, Bretton Woods era.

– So US interests would identify countries rich with natural resources and with possibly non-democratically elected governments. The phrase ‘US interests’ is used deliberately here since it would later allow for a possible detraction and an escape route to denial and a possible high moral ground.

– Pocket the leaders of such nationalities and send in a team of consultants to the country (these would NEVER be on the payroll of the US Government)

– Cook up statistics and IRR and all assorted crap about a development plan and come up with an investment plan.

– Get the Bretton Woods sisters (the IMF and the World Bank) to provide loans. ‘Engineer’ things such that work contracts (construction activity mostly) were always awarded to US companies. Ensure that such countries remain indebted.

It talks about the assasinations of President Aguilera of Ecuador and President Torridos of Panama. Then about the US invasion of Panama (Dec 1989) to extradite President Noreiga done despite severe international opposition and violation of internal law. Air strikes on a country as threating as Panama? The book notes that the then President George H. W. Bush was under pressure to shed the wimpy image that the US media was heaping upon him. It also questions if killing thousands (though US media reported far far less) to remove one man accussed of drug trafficking, racketeering and money laundering is anti wimpy. The book says that Noreiga was negotiating with the Japanese to build a second canal in the Panama. What was interesting for me to read is that another anti-EHM, Saddam Hussein was castigated by the US for violating international law when he decided to strike Kuwait less than a

It talks about the assasinations of President Aguilera of Ecuador and President Torridos of Panama. Then about the US invasion of Panama (Dec 1989) to extradite President Noreiga done despite severe international opposition and violation of internal law. Air strikes on a country as threating as Panama? The book notes that the then President George H. W. Bush was under pressure to shed the wimpy image that the US media was heaping upon him. It also questions if killing thousands (though US media reported far far less) to remove one man accussed of drug trafficking, racketeering and money laundering is anti wimpy. The book says that Noreiga was negotiating with the Japanese to build a second canal in the Panama. What was interesting for me to read is that another anti-EHM, Saddam Hussein was castigated by the US for violating international law when he decided to strike Kuwait less than a  year of the Panama invasion! I guess we have different laws for different states. But this time I guess Bush was able to shed his wimpy image and see his popularity ratings soar to 90% amongst the Americans and get more international support since Saddam himself was quite a dark guy. I was preparing for my board exams and seemed to miss much of this – who cares anyways when you are the most important point of your academic life. But when the twin towers were felled, I was very much hooked on to the news feeds. I talked about causality in my previous post – and now I wonder if we can see some causal relationship between today’s threat of terrorism on US soil and the policies of post Carter US. Just thinking. Hope no causality exists.

year of the Panama invasion! I guess we have different laws for different states. But this time I guess Bush was able to shed his wimpy image and see his popularity ratings soar to 90% amongst the Americans and get more international support since Saddam himself was quite a dark guy. I was preparing for my board exams and seemed to miss much of this – who cares anyways when you are the most important point of your academic life. But when the twin towers were felled, I was very much hooked on to the news feeds. I talked about causality in my previous post – and now I wonder if we can see some causal relationship between today’s threat of terrorism on US soil and the policies of post Carter US. Just thinking. Hope no causality exists.

The lure of lucre and the power of world domination is understandable. The English practised their own form of ‘corporatocracy’ using the East India Company as their front. The Portguese did it though the Spanish conquistadors were more infamous and direct in their methods. I am sure even the Gupta empire in early India did it when it touched places like the Malay peninsula, Singapore, Ceylon, etc.

Whatever be the motivation and regardless of the official stand of the Government the book is a must read. It took immense resolve on the part of the author to write the book. Read it.

_______________________________________________________________________________________

From cross border economic shenanigans that look like a lift out from Bond movies to real bonds closer home:

If you remember, the recent Union budget had the Finance Minister announcing the re-introduction of tax saving infrastructure bonds. I remember having picked up some tax saving infrastructure bonds issued by ICICI and IDBI during the period 2001-2003. To save tax. My salary was lower then than what it is now and therefore a penny of tax saved had greater marginal utility, though the opportunity cost was HUGE since the equity markets were shooting up like crazy, picking themselves up from the dot com destruction. Today the situation is different since according to me the opportunity cost has reduced (not too many bargains to be found in the secondary capital market). But regardless of that, saving taxes is a virtue which increases one’s take home pay.

If you remember, the recent Union budget had the Finance Minister announcing the re-introduction of tax saving infrastructure bonds. I remember having picked up some tax saving infrastructure bonds issued by ICICI and IDBI during the period 2001-2003. To save tax. My salary was lower then than what it is now and therefore a penny of tax saved had greater marginal utility, though the opportunity cost was HUGE since the equity markets were shooting up like crazy, picking themselves up from the dot com destruction. Today the situation is different since according to me the opportunity cost has reduced (not too many bargains to be found in the secondary capital market). But regardless of that, saving taxes is a virtue which increases one’s take home pay.

IFCI has been the one first off the block in issuing these infrastructure bonds. Here is the term sheet of the issue. A lot of material can be found on the internet so I will not ham. Check out this post on finwinonline – it covers the topic well. I have the following observations:

-

All should invest. Period. Currently there is no substitute to IFCI bonds today and this gives you an INR 20,000 additional deduction from your taxable income (Section 80 CCF). Invest till 20,000 unless you are unweight and/or love investing in fixed income instruments. You can invest more, but A) you’ll not get the tax benefit and B) the yield will not be mouthwatering.

-

While the deadline is 31Aug’10 and you need to have a demat account to apply, no need to fret in case you still have not opened a demat account. Other similar issues will indeed follow but the question is will they be at par or under or higher? (in terms of interest offered on the bonds).

-

Since India does not (yet) have a deep corporate bond market, the Finance Ministry has done good to institute a buy back option for the bond holders after the mandatory 5 year holding period. Presence of this exit option has definitely made these 10 year bonds quite attractive to investors.

-

The other good bit is that since these bonds would be sold through the Bombay Stock Exchange (BSE), capital gains tax will apply on redemption (instead of the gains being taxed at the individual’s tax rate) and there will be no Tax Deducted at Source (TDS).

-

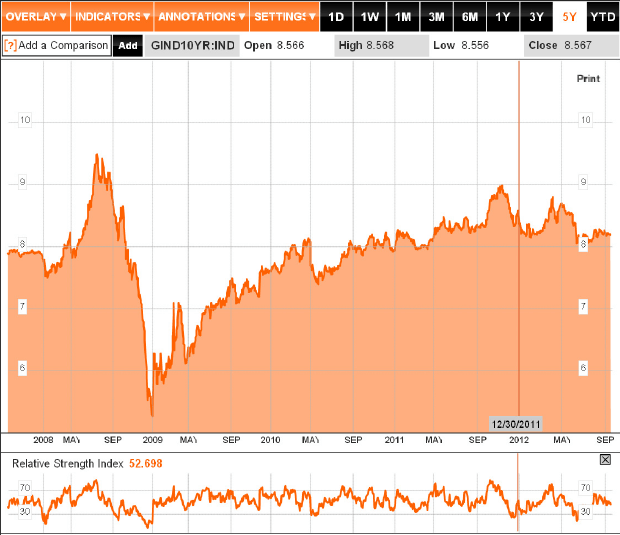

The other important aspect about the issue is the generous waiver granted by the Finance Ministry of the necessity to procure and publish credit ratings of the issue/issuer as part of the issue. This is cool, right (sarcasm)? Is that why IFCI rushed in first off the block? So, according to me, you might not lose much in case you are a bit strapped for funds at the moment and are not apply to the IFCI issue. Also, I am not aware of the % of allocation in case the total retail appications are more than the bonds available. The reason for that is that A) you have a quota of INR 20,000 to fill; B) it is quite likely that local interest rates will rise in the near future; so C) even if you have other slightly stronger issuers (LIC, IFCI, IDBI, other NBFCs?) throwing out their paper, the dip in coupon induced by their stronger credit worthiness may be offset by the rising interest rates.

-

Appopros my earlier post re IFCI (

License to Bank, dt 5Jul2010), I guess I am in two minds now given this development. It may be possible that the banking license eludes IFCI. Some people are talking about the company selling out to a strategic investor. The Government of India has people on the board of IFCI and since extant shareholding issues are yet to be sorted out, I think the banking license trigger may not apply. While the position is 9.43% in the black for me, this is yet another instance where I’ve broken one of my resolves – to never put money on investment theories which have a digital event at the core of their persuasion.

Finally, the last word on the infrastructure bonds is the sense of equality it provides us common folk while our political leaders clamour for two successive salary hikes in two weeks – and get it as well. I think there is an outstanding demand by our leaders to make their salary tax free as well. If that happens, I know that I will puke on my pizza.

Please scatter it around:

Recent Reactions