For most of the day today, I have been reading a bit about the Great Depression (GD) of the Thirties and Forties in the US. It is natural to compare the events and situation of today to those times and hope that the lessons from the GD can be applied in today’s situation as well. If the GD tableau is to really serve as a money management lesson then it is very important to establish the fact that the two scenarios were actually quite similar.

That is where the fun begins. Many eminent people (Incl Ben Bernanke) have maintained that the current situation (i.e. the Great Recession) is not the same, nor similar to the GD of earlier times. It is stated that during the 12 years of the GD, the unemplyment rate went upto 25%, a third of the US banks went bust, the US GDP fell by a third and the US stock market fell by 90%. Nothing like that is happening today, so what we are experiencing today is just a recession. It may be a great one, but it is not a depression. Well, what if the unemployment figures of the GD were inflated and the emplyment statistics of today are being supressed for some reason? The reason why so many banks did not fail during this time is because the government (actually, all over the world) stepped in and bailed them out. The book I am reading says, “between 1923 and 1929 banks across the country failed at an astonishing rate of two a day, but the rising prosperity masked those failures”. Which means the banking norms then were not as mature as they are today. So, here’s a question: in today’s age, aren’t events at Lehman, Bear Stearns, Citi, JPMorgan, AIG, BofA, Freddie Mac, Fannie Mae etc equivalent of those banks failing then. Comparing on numbers isn’t correct since consolidation in the banking industry hadn’t happened during those times. Click here for a very lucid article of the comparision between the RD and the GD.

The GD was truly a scary time. People living today (esp outside of the US) would find it difficult to comprehend or associate such times with the US. Of course, financial hardships caused by famine, war, natural disasters is common is many parts of the world (incl. India) but to think that the people who lived in the engine room of the world’s economy had to stand in “bread lines” to get food is both surprising and revealing at the same time. Well, the bread lines formed because there was little or no social security net in the US during that time. If the GD would have never happened and therefore if social security would have never come about, wouldn’t the GR of today become similar to the GD of those times? Here is an extract from the book I am reading which in turn is an extract of an anonymous letter which a 12 year Chicago boy had written to the “Mr. and Mrs. Roosevelt in Washington D.C.”

The GD was truly a scary time. People living today (esp outside of the US) would find it difficult to comprehend or associate such times with the US. Of course, financial hardships caused by famine, war, natural disasters is common is many parts of the world (incl. India) but to think that the people who lived in the engine room of the world’s economy had to stand in “bread lines” to get food is both surprising and revealing at the same time. Well, the bread lines formed because there was little or no social security net in the US during that time. If the GD would have never happened and therefore if social security would have never come about, wouldn’t the GR of today become similar to the GD of those times? Here is an extract from the book I am reading which in turn is an extract of an anonymous letter which a 12 year Chicago boy had written to the “Mr. and Mrs. Roosevelt in Washington D.C.”

I’m a boy of 12 years. I want to tell you about my family. My father hasn’t worked for 5 months. He went plenty times to relief, he filled out application. They won’t give us anything. I don’t know why. Please you do something. We haven’t paid 4 months rent. Everyday the landlord rings the doorbell, we don’t open the door for him. We are afraid that we will be put out, been put out before, and don’t want to happen again. We haven’t paid the gas bill, and the electric bill, haven’t paid grocery bill for 3 months. My father he staying home. All the time he’s crying because he can’t find work. I told him why are you crying daddy, and daddy said why shouldn’t I cry when there is nothing in the house. I feel sorry for him…Please answer right away because we need it or we will starve. Thank you. God bless you.

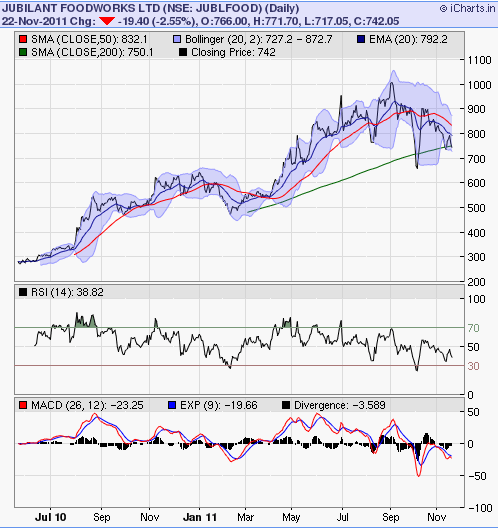

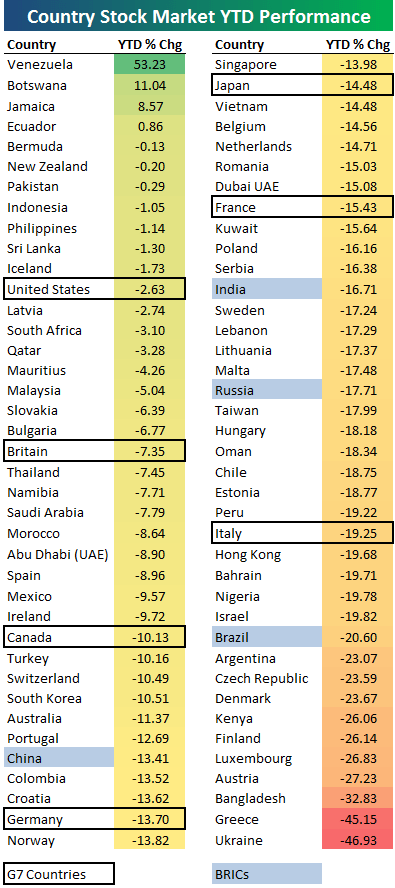

I am pretty certain that there are 12 year old boys in the US, who would not be so misplaced in today’s times as to not write similar letters. Ultimately, it is best for plebians like us to assume that financial “experts” are often wrong and that astrology and economics don’t mix. Earlier, they’d say India has de-coupled from the world! After that, the grey cells started debating nuances on whether the current “slowdown” is a recession or not. However all are now of one voice when they say that A) India is as coupled to the world economy as copper is to iron in a bimetallic strip and B) we are indeed in a recession. Is the realisation that we are in a depression around the corner as well? If that happens then you may as well desert equity as an asset class to base your future planning on…

Please scatter it around:

Recent Reactions