TV Everywhere? Or Nowhere?

21-Mar-12 Leave a comment

Delhi, Mumbai, Chennai and Kolkata will replace all analog telly networks with digital ones come 1Jul’12. That’s causing a nice fight to develop between Multi System Operators (MSOs) and the Direct To Home (DTH) gang. The last mile connectivity providers, i.e. the local cable operators were being squeezed in between. However necessity has forced Dish TV, a DTH company to innovate by tying up with the local cable companies. The local cable companies will serve as the distribution channel partners of Dish TV and also as sales ushers by pushing the Dish TV set-top boxes in cable households to coincide with the first phase of cable digitization which begins on 1Jul’12. All very nice and funny since Dish TV earlier used to tout itself as a business which provided an alternative to the monopoly of the local cable guys (see pic alongside)! Very confusing since now there are news that the cable companies are jamming signals of DTH transmissions in Mumbai and Delhi!

Delhi, Mumbai, Chennai and Kolkata will replace all analog telly networks with digital ones come 1Jul’12. That’s causing a nice fight to develop between Multi System Operators (MSOs) and the Direct To Home (DTH) gang. The last mile connectivity providers, i.e. the local cable operators were being squeezed in between. However necessity has forced Dish TV, a DTH company to innovate by tying up with the local cable companies. The local cable companies will serve as the distribution channel partners of Dish TV and also as sales ushers by pushing the Dish TV set-top boxes in cable households to coincide with the first phase of cable digitization which begins on 1Jul’12. All very nice and funny since Dish TV earlier used to tout itself as a business which provided an alternative to the monopoly of the local cable guys (see pic alongside)! Very confusing since now there are news that the cable companies are jamming signals of DTH transmissions in Mumbai and Delhi!

Will have to see how all of this plays out – DTH companies like Dish TV and Tata Sky claim that they have shelled out close to 20k crores towards digitisation. The current debt on Dish TV’s books is Rs. 1,200 crores already with much of it being USD denominated making it very vulnerable to INR’s depreciation. A bigger concern is that the promoters had already pledged a huge “dish” full of shares and now they’ve done more. Perhaps financial stretch will force consolidation in the infantile industry. The six private DTH platforms in India are: Dish TV, Tata Sky, Sun Direct, Reliance Digital TV, Airtel Digital TV and Videocon d2h.

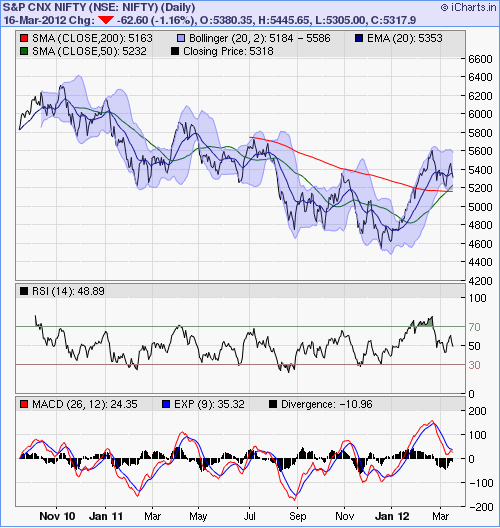

Here’s the trailing 18 months chart of Dish TV. It is selling at its 52 week low but that is nothing to suggest that it may not go on to celebrate its 60/70 week low as well. The chart certainly looks bearish for now, but yes, the 50 DMA may very well begin its rise leading up to the 1Jul’12 deadline. My sense says avoid. At this point in time, I have not read and studied enough about this game to form any opinion at all. But yes, the fact that India has more than 100 million television enabled homes is very significant.

Here’s the trailing 18 months chart of Dish TV. It is selling at its 52 week low but that is nothing to suggest that it may not go on to celebrate its 60/70 week low as well. The chart certainly looks bearish for now, but yes, the 50 DMA may very well begin its rise leading up to the 1Jul’12 deadline. My sense says avoid. At this point in time, I have not read and studied enough about this game to form any opinion at all. But yes, the fact that India has more than 100 million television enabled homes is very significant.

There is something seriously wrong in the Indian television and media broadcasting space. Even if the stocks are tempting on the technicals, the crazy amount of flux in the industry is just reason enough to avoid punting in them. There is a bit of a chorus coming out about Dish TV being under-valued and that it is a value play now that it is at its 52 week lows. It’s being pegged at a target of 80 in 24 months! There are also reports out there which are predicting the Indian television sector to grow at 17% compounded over the next 4 – 5 years! If that be the case then why did Rupert Murdoch’s News Corp sell its stake in Hathway after staying with its investment for more than 10 years? Zee split; Den networks has packed its den with debt; media companies like NDTV, TV Today, TV18 etc are moribund as ever; Sun TV got tainted by corrupting sun spots; ENIL’s mirchi is anything but hot on the bourses; and so on….

The latest RBI working paper invites public comments on the topic “

The latest RBI working paper invites public comments on the topic “

Recent Reactions