“Don’t put all your eggs in one basket”. That’s what Cervantes made the rotund Sancho Panza say in his book Don Quixote. The view expressed across the Atlantic, however, was quite different. Mark Twain told us to put all eggs in one basket and to watch that basket very carefully. Wise wits and financial advisors take Cervantes’ cue and tell us to scatter our assets and attention. The saying undoubtedly originated from the simple observation that if you put all your eggs in one basket and if you were to drop that basket, then you’d lose all your precious eggs. If I were a CFA or a wealth advisor I’d have egg on my face if I said that I believed that Mark Twain was right, but since I am not, I am going to exactly do that in this post! It’s important to understand the context in which it’s good to diversify and where it is not. This is the context I am referring to: make a pie chart of your wealth and ensure that you always have 3 – 4 wel diversified slices in it. Within the particular slice of the pie that indicates your equity exposure, you shouldn’t have too many further sub divisions. Many people interpret the eggs in one basket to mean that they need to own multiple stocks and multiple mutual funds!

“Don’t put all your eggs in one basket”. That’s what Cervantes made the rotund Sancho Panza say in his book Don Quixote. The view expressed across the Atlantic, however, was quite different. Mark Twain told us to put all eggs in one basket and to watch that basket very carefully. Wise wits and financial advisors take Cervantes’ cue and tell us to scatter our assets and attention. The saying undoubtedly originated from the simple observation that if you put all your eggs in one basket and if you were to drop that basket, then you’d lose all your precious eggs. If I were a CFA or a wealth advisor I’d have egg on my face if I said that I believed that Mark Twain was right, but since I am not, I am going to exactly do that in this post! It’s important to understand the context in which it’s good to diversify and where it is not. This is the context I am referring to: make a pie chart of your wealth and ensure that you always have 3 – 4 wel diversified slices in it. Within the particular slice of the pie that indicates your equity exposure, you shouldn’t have too many further sub divisions. Many people interpret the eggs in one basket to mean that they need to own multiple stocks and multiple mutual funds!

According to me, it’s obviously important to have a little diversification and redundancy but generally small investors take this to the extreme. They play with woefully small stakes. So even if they bag multi-baggers it hardly grows their personal wealth. Even if you get a 3x return what’s the point if all that you have running on it is a measly 10,000/-? If I have to talk co-variances and correlations, the multi-basket approach only works if the baskets are independent. Which means that it is obviously a great idea to spread your wealth across (mostly non-correlated) asset classes like gold (not too much please!), real estate (uncorrelated really?), stocks, equity mutual funds, fixed income (PPF, bonds, debt MFs) etc. Fixed income may be interesting over a 2 – 3 year horizon if the local interest rates move down. If you noticed, I did not mention insurance since I do not consider that asset class as an investment, sorry.

But it’s a horrible idea to spread your investments across > 15 stocks (just to pick a number, my Kelly Formula post notwithstanding). Why? Because its impossible for a small investor with a daily job to digest all those bits and bytes of information that get generated in the financial marketplace everyday. You can’t monitor multiple baskets beyond a point. By spreading your capital across multiple stocks you are certainly setting yourself up for cleaning the mess that’s soon to appear on your floor. Be careful with those egg shells when you walk, you may bleed (in more ways than one).

If I have lost you or you remain skeptical, then let me try some other way. Let’s try to visualise as to why you may want to keep all your eggs in one basket:

-

You have only one egg [well. you shouldnt be in the markets. Line up to buy Super Lotto.]

-

You have only one arm [I do. I am not ambidextrous – juggling work and finances and home and hobbies is challenging on me. Quality suffers. So I have only one arm to give for monitoring my trades]

-

You need all your eggs [which means dropping one basket with all eggs will cause you similar grief as dropping some baskets]

-

It’s a trash basket [all your eggs are already broken or rotten – i.e. hopeless loss making holdings. I’d strongly urge you sell off all your shares (if they are really broken or rotten) and A) start fresh and B) start reading this post from the top!]

-

You eggactly know what you have [i.e. you’ve focused on a few ideas but really thought very deeply & are honest to admit to yourself what you don’t know]

-

Last time you spread your eggs across baskets you dropped a few of them [This is true in my case and the following paragraph talks about that]

A past colleague and good friend drilled this message into me. Since then (this was nearly 3 years ago) I have consciously tried to reduce the number of positions I have at any given point in time in a bid to improve my performance. I have been resonably able to limit my holdings to a few, and I can now stand up in front of the mirror and talk about the basis for each of my speculation – when bought, how many shares bought, why bought, when will I fold, maximum loss threshold etc. It was impossible to do this when I had > 15 stocks in my portfolio.

The challenge here? As your portfolio size increases having just 5 – 6 stock positions at any given point in time means your stakes go really high. If you cannot make the mental shift to think in % terms and remain rooted to absolute rupee amounts, then this focus will be impossible to achieve. You will either end up being under-invested in equity (since it’s too much work) or have loads of positions to monitor.

Finally, inspired as I am by Mark Twain, let me invent a quote: “Never own more stocks than there are colours in a rainbow!” Am I an egghead or what? 🙂

Please scatter it around:

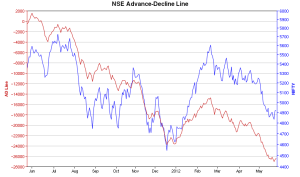

Here are two plots – the first is the daily breadth of the NSE listed stocks (the A/D ratio). The A/D line is at it near lowest since the past 12 months with the benchmark index also moving in the same lock and step with the A/D line. This chart is from http://icharts.in and I was too lazy to plot the broader market indices (other than NIFTY) but even then the NIFTY superimposition on the NSE A/D line does seem to point to some trend reversal in the days to come.

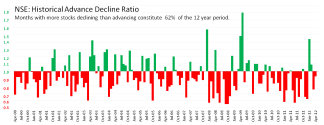

Here are two plots – the first is the daily breadth of the NSE listed stocks (the A/D ratio). The A/D line is at it near lowest since the past 12 months with the benchmark index also moving in the same lock and step with the A/D line. This chart is from http://icharts.in and I was too lazy to plot the broader market indices (other than NIFTY) but even then the NIFTY superimposition on the NSE A/D line does seem to point to some trend reversal in the days to come. The second chart shows the monthly A/D ratio for all NSE stocks. The months which had more stocks falling are shown as red negative columns. The chart is more red than green despite the NIFTY having returned 236% during the same period which represents a gain of 10.9% compounded per annum. I guess this hints at the quality of listings on the NSE. The action is always in the frontline stocks – not that you needed a chart to reveal that! But maybe the visual might serve its purpose if it makes you pause and rethink any decision of yours that may be asking you to throw money on small, unloved, thinly traded and operator driven stocks.

The second chart shows the monthly A/D ratio for all NSE stocks. The months which had more stocks falling are shown as red negative columns. The chart is more red than green despite the NIFTY having returned 236% during the same period which represents a gain of 10.9% compounded per annum. I guess this hints at the quality of listings on the NSE. The action is always in the frontline stocks – not that you needed a chart to reveal that! But maybe the visual might serve its purpose if it makes you pause and rethink any decision of yours that may be asking you to throw money on small, unloved, thinly traded and operator driven stocks.

Recent Reactions